causeway international value

Foreign Large Value Fund Inception 10262001 Exp Ratio Gross 114 1272022 Exp Ratio Net 11 1272022 NAV 1485 6162022 Minimum to Invest 3 500000 Turnover Rate 60 9302021 Portfolio Net Assets M 612686 5312022 Share Class Net Assets M 34105 5312022 12 Month Low-High 1480 - 1845 5312022 Hypothetical Growth of. Causeway International Value Fund CIVVX Nasdaq - Nasdaq Delayed Price.

Giant S Causeway And Causeway Coast World Heritage Outlook

Has changed its name and has a new CUSIP andor symbol Has been delisted and the ticker has changed.

. That generally either pay dividends or repurchase their shares. There are no current stakeholders of Causeway International Value I. Causeway International Value Fund Class Institutional-414.

Causeway co-founders Sarah Ketterer. This is normal when the security. The fund boosted its Rolls-Royce Holdings LSERR position by 99791780 shares or 26947 for a total investment of 136824608 shares.

Causeway International Value Profile The Causeway International Value Fund was established on October 26 2001. Rowe Price International Value Eq I -299 076 2098 -1804 2094 192 1293 -1371 Mondrian International Value Equity -393 402 2142 -1174 1797. Find company research competitor information contact details financial data for Causeway International Value Group Trust of Los Angeles CA.

Causeway International Value Inv CIVVX Morningstar Analyst Rating Analyst rating as of Nov 9 2021 Quote Chart Fund Analysis Performance Sustainability Risk. Causeway International Value Fund 163400 USD 01400 086 Add To Watchlist Market Closed As of 06062022 EDT Youve reached your free article limit. Fees are Average compared to funds in the same category.

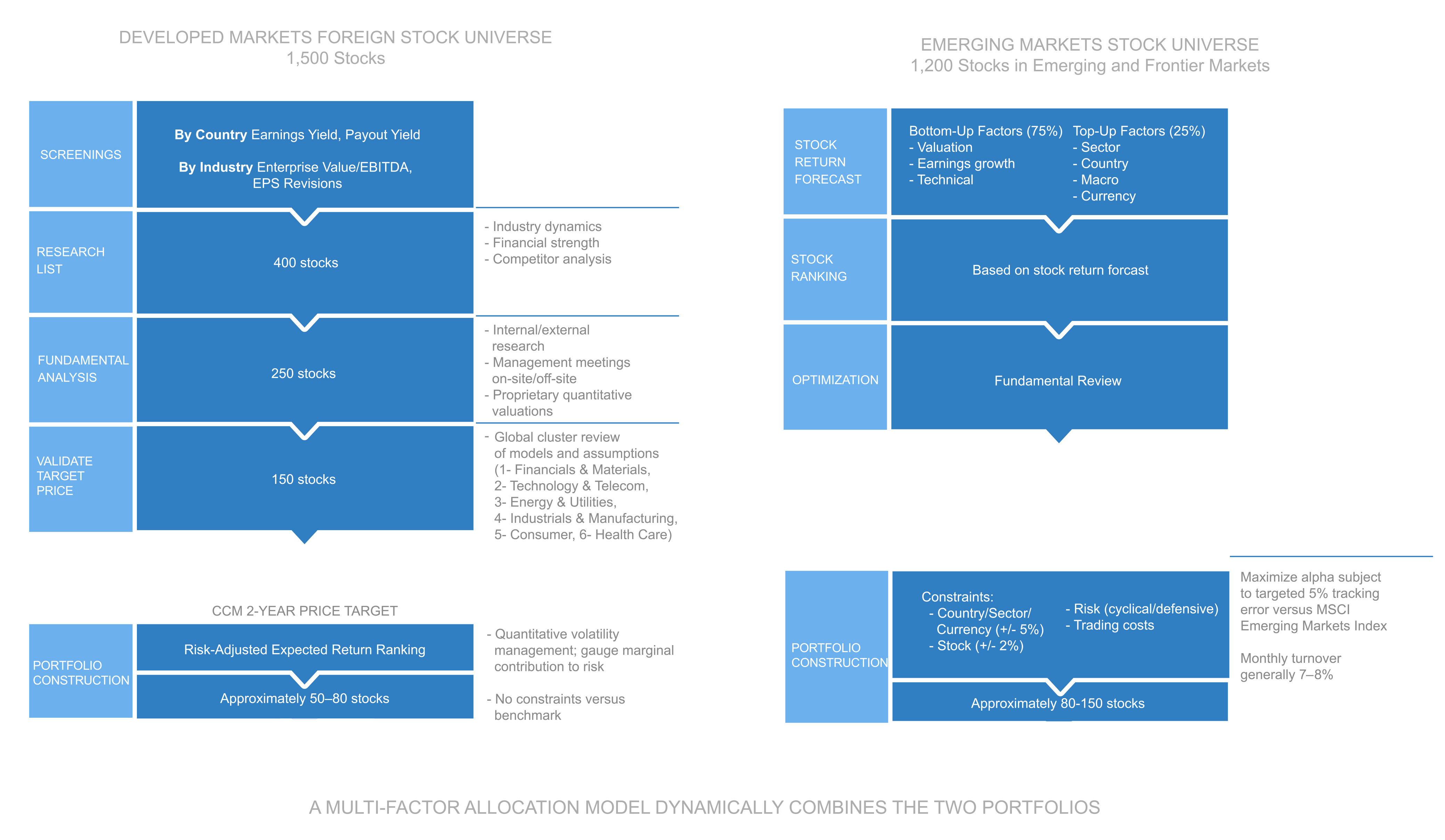

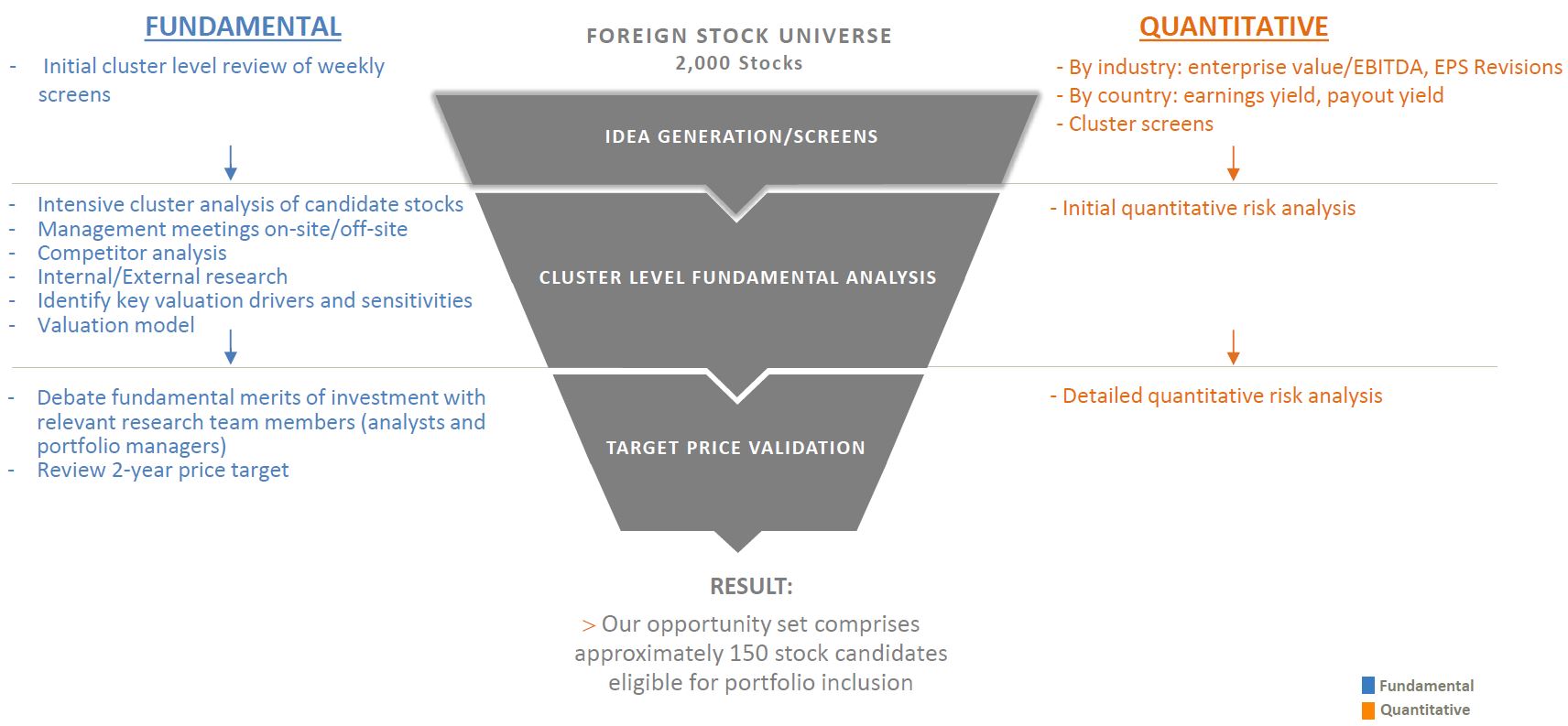

Currency in USD 2W 10W 9M 1520 -003 -020 As of 0806AM EDT. Sarah Ketterer Trades Portfolios Los Angeles-based Causeway Capital Management was founded in 2001Executing a bottom-up investment strategy based on fundamental research the portfolio managers look for value opportunities among mid- to large-cap companies in developed international markets to achieve long-term capital growth. Causeway International shows a prevailing Real Value of 1452 per share.

JNLCauseway International Value Sel I -331 019 2875 -1726 1930 623 876 -1403 MSCI ACWI Ex USA Net Total Return -566 450 2719 -1420 2151 1065 782 -1897 T. The fund invests in public equity. JNLCauseway International Value Select Fund Class A Add to watchlist 0P00003D1Z Actions Price USD 1456 Todays Change 037 261 1 Year change -- Data delayed at least 15 minutes as of Jun.

The trade had a 270 impact on the equity portfolio. The international value portfolio is constructed from an equity universe composed of companies with market capitalizations typically greater than 1 billion located throughout the non-US developed and emerging market countries. CERTIFIED SHAREHOLDER REPORT OF REGISTERED.

The current price of the fund is 1598. The fund managers seek long-term growth of capital and income by investing in companies in developed countries outside the US. SECURITIES AND EXCHANGE COMMISSION.

Causeway International Value Fund Class Institutional Add to watchlist CIVIX Actions Price USD 1534 Todays Change 041 275 1 Year change -1539 Data delayed at least 15 minutes as of. Causeway International Value Equity CIT Class 1 Fund 1059 -009 -084 06232022 1200 AM NAV Add to watchlist intraday 1w 1m 6m ytd 1y 3y 5y max Indicators Mountain-Chart Date Asset Allocation. Causeway International Value Fund has an expense ratio of 108 percent.

Causeway International Value still has far more than its share of strengths and both of its share classes continue to merit Morningstar Analyst Ratings of Gold. 52 Week Range 1491 - 1838 YTD -1265 5 Year 1057 Total Net Assets 5786B Yield 192 Net Expense Ratio 085 Turnover 60 52 Week Avg Return. Please use Search to find the security you were looking for.

Causeway International Value Fund Overview Overall Score 6810 26 in Foreign Large Value Overview Interactive Chart Performance Holdings Costs. Has merged with another entity. MANAGEMENT INVESTMENT COMPANIES.

At this time the entity appears to be overvaluedWe determine the value of Causeway International from analyzing fund fundamentals and technical indicators as well as its Causeway International from analyzing fund fundamentals and technical. Through rigorous bottom-up company analysis we seek to identify undervalued stocks with upside potential. Causeway Capital Management Trust - Causeway International Value Fund is an open-end equity mutual fund launched and managed by Causeway Capital Management LLC.

Has been acquired or taken private. 1m YTD 1y 5y Max Full screen Were sorry we.

.png)

Causeway Networking Membership Benefits

Causeway International Value Fund Buys Rolls Royce Dumps Aviva

Causeway Defined Growth Fund A Usd Ie00bjvqr086

Causeway Capital Management International Opportunities Fund

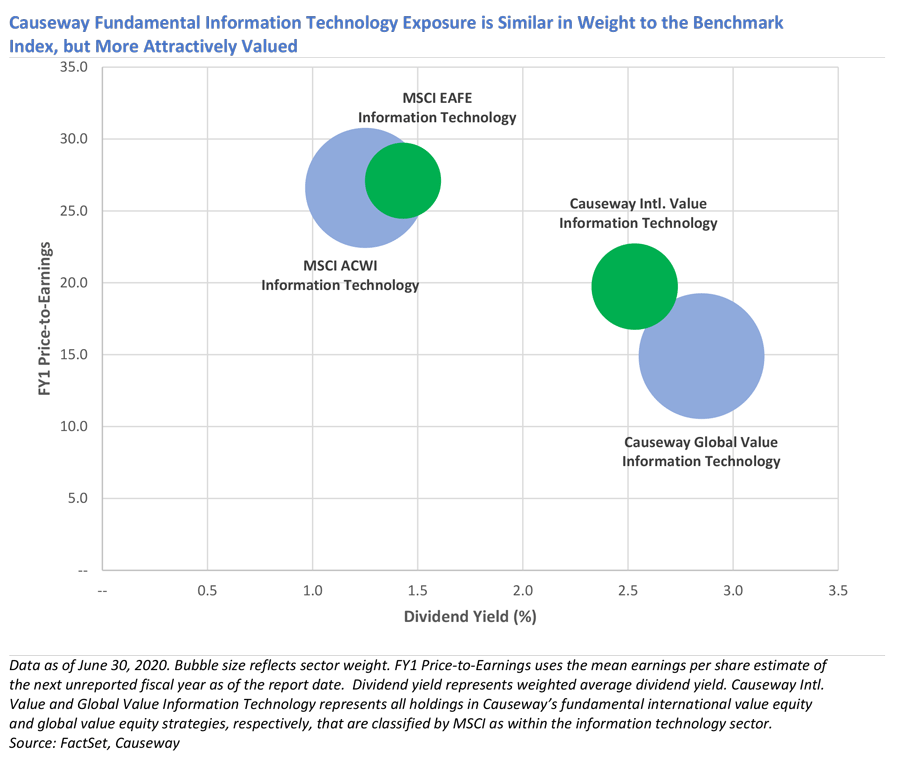

A Value Investor Uncovers Opportunities In Technology Causeway Capital

Causeway Capital Management Crunchbase Investor Profile Investments

Causeway International Value Fund Buys Rolls Royce Dumps Aviva

Causeway Capital Causewaycapital Twitter

Causeway International Value Fund Buys Rolls Royce Dumps Aviva

Causeway International Value Fund Buys Rolls Royce Dumps Aviva

Causeway Capital Management International Value Fund

Causeway Capital Management Causeway Analytics

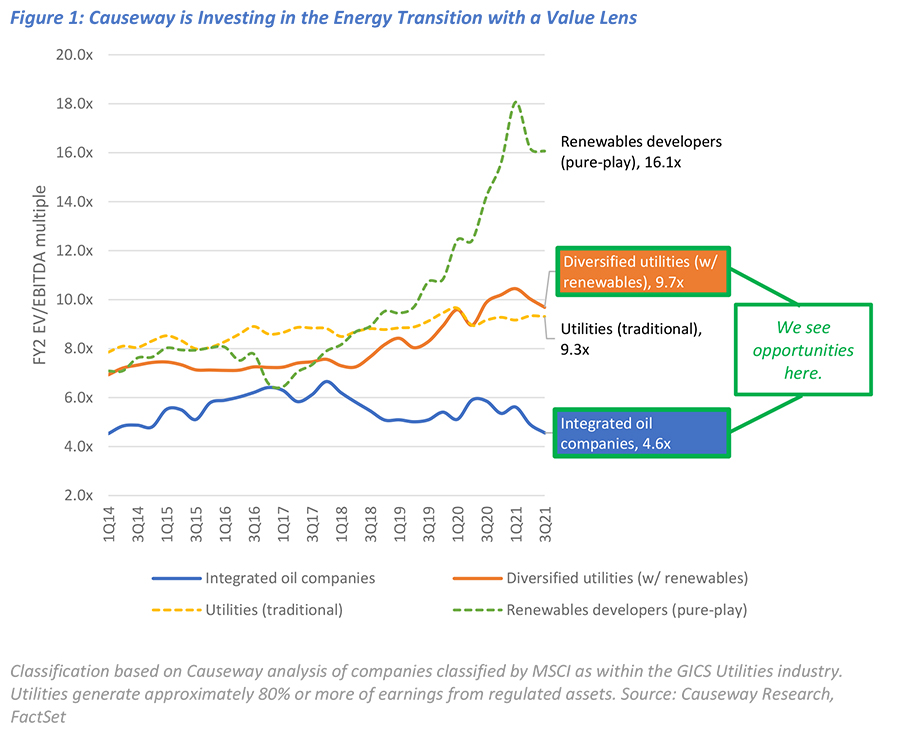

Value Investing In The Energy Transition

Causeway International Value Fund Buys Rolls Royce Dumps Aviva

Causeway International Value Fund

Causeway International Value Fund

Causeway International Value Fund Buys Rolls Royce Dumps Aviva

Causeway International Value Fund Buys Rolls Royce Dumps Aviva

Causeway Capital Management International Value Fund

0 Response to "causeway international value"

Post a Comment